Mortgage rates today

Your rate might be different based on your finances. Get a personalized quote with no impact to your credit score using our online pre-approval.

Get my rateMortgage rates are the interest rates banks charge when you take out a loan to buy a home. These rates change depending on the economy, decisions made by the Federal Reserve, and market trends.

The rate you get on your mortgage affects how much you can afford and how much interest you’ll pay over time. That’s why it’s important to know the current rates if you’re buying a home or refinancing.

The lower the interest rate, the less you pay each month. For example, if you borrow $400,000 for 30 years at 6% interest, your monthly payment would be $2,396. But if the rate is 5.5%, the payment goes down to $1,960.

The rate you get for your mortgage depends on your finances, the details of your loan, and the overall economy.

Credit Score: Your credit score is like your financial report card. A higher score usually means a lower interest rate, while a lower score can lead to a higher rate.

Down Payment: If you can pay 20% or more upfront, lenders see you as less risky, which can get you a lower interest rate.

Loan Term: How long you take to pay off your loan affects your rate. A shorter term, like 15 years, usually has a lower rate but higher monthly payments. A longer term, like 30 years, has a higher rate but lower payments each month.

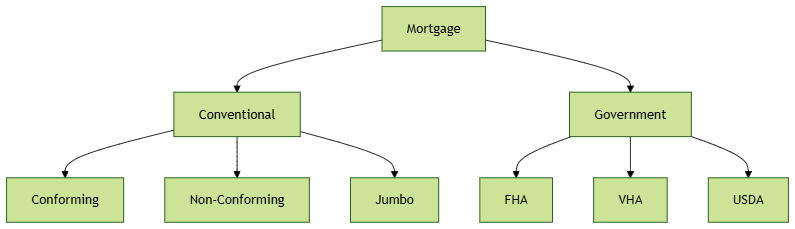

Loan Type: The kind of loan you pick, like a regular loan or an FHA loan, can also change your rate. Different loans come with different perks and rules, so it’s important to find the one that’s best for you.

Points and credits: Points are extra fees you pay when you close on your home to lower your interest rate. This is a good idea if you plan to stay in the home for a long time. Credits, on the other hand, can help cover closing costs or other fees, but they might increase your interest rate. It’s a trade-off between paying more upfront or paying more over time.

For example

Imagine you’re getting a $300,000 loan.

-

Points: If you pay 1 point, which is $3,000 (1% of $300,000), you could lower your interest rate from 4% to 3.75%. This means lower monthly payments and more savings over time if you stay in the house for years.

-

Credits: If you choose a higher interest rate, like 4.25%, the lender might give you $3,000 in credits to cover some of your closing costs. You’ll pay less upfront, but your monthly payments will be higher, costing you more over time.

The Fed: The Federal Reserve, is like the boss of the U.S. economy. When they change their rules about money, it can make mortgage rates go up or down. If they raise rates, your mortgage rate could go up, and if they lower rates, your mortgage rate might go down.

Picking the right mortgage rate is key to getting a good deal on your home loan. Here’s what to think about:

Fixed vs. Adjustable Mortgage

First, decide between a fixed-rate and an adjustable-rate mortgage (ARM). A fixed-rate mortgage keeps the same interest rate for the entire loan, making your payments predictable. An ARM starts with a fixed rate for a few years, then the rate can change. Each option has its pros and cons, so choose based on what suits your financial goals.

Shop around for lenders

It’s important to compare rates from different lenders to find the best deal. Get quotes from multiple lenders and mortgage brokers. Also, consider the lender’s reputation, customer reviews, and the expertise of the loan officer.

Think about the loan term length

The length of your loan term affects your payments. A 30-year mortgage has lower monthly payments but costs more in interest over time. A 15-year mortgage has higher payments but saves you money on interest. Choose the term that best fits your budget and financial goals.

Look at APRs

When comparing rates, check the APR (Annual Percentage Rate), not just the interest rate. The APR includes the interest rate plus fees and other costs. For example, if Lender A offers 5.50% with a 6.20% APR, and Lender B offers 5.75% with a 6.10% APR, Lender B’s loan is actually cheaper over time.

The APR doesn’t just show the interest rate; it also includes the lender’s fees and other costs, like points you can pay upfront to lower your rate. This gives you a clearer picture of the total cost of the loan.

Beware of bait and switch

Some lenders may advertise low rates but later increase them along with extra fees. Always ask for a loan estimate, which provides a clear, standardized comparison, instead of relying on a less detailed “fee worksheet.”

Compare fees

Look closely at sections A and B of your loan estimate to see what fees each lender charges. This will help you spot which lender offers the best deal. At Kassa, we work to keep your costs low and avoid unnecessary fees.

Think about rate locks

A rate lock secures your interest rate for a certain period, usually 30 to 60 days. This can be a good idea if rates are expected to rise, protecting you from any increases during that time.

Your monthly mortgage interest payment is based on the annual interest rate divided by 12. For example, if your annual rate is 4%, your monthly rate is about 0.333% (.04/12 = .00333). This percentage is applied to the remaining loan balance each month, so the interest amount changes as you pay off more of the loan.

For fixed-rate mortgages, the overall payment stays the same throughout the loan term, consisting of two parts: principal and interest. The principal is the amount you still owe on the loan.

To see how interest payments are spread over the life of a loan, use an amortization calculator. Here’s an example for the first year of a 30-year fixed loan of $400,000 at a 6% interest rate.

| Month | Monthly Payment | Principal | Interest | Loan balance |

|---|---|---|---|---|

| 1 | $2,398.20 | $476.52 | $1,921.68 | $383,859.86 |

| 2 | $2,398.20 | $478.90 | $1,919.30 | $383,380.96 |

| 3 | $2,398.20 | $481.30 | $1,916.90 | $382,899.66 |

| 4 | $2,398.20 | $483.70 | $1,914.50 | $382,415.96 |

| 5 | $2,398.20 | $486.12 | $1,912.08 | $381,929.84 |

| 6 | $2,398.20 | $488.55 | $1,909.65 | $381,441.29 |

| 7 | $2,398.20 | $490.99 | $1,907.21 | $380,950.30 |

| 8 | $2,398.20 | $493.45 | $1,904.75 | $380,456.85 |

| 9 | $2,398.20 | $495.92 | $1,902.28 | $379,960.93 |

| 10 | $2,398.20 | $498.40 | $1,899.80 | $379,462.53 |

| 11 | $2,398.20 | $500.89 | $1,897.31 | $378,961.64 |

| 12 | $2,398.20 | $503.39 | $1,894.81 | $378,458.25 |

No, you don’t have to stick with the same rate forever. You can refinance your mortgage whenever it makes financial sense. If interest rates have dropped since you got your original loan, refinancing could lower your monthly payments and save you thousands in interest over time. Just remember to factor in costs like closing fees to make sure the savings are worth it.

Understanding mortgage rates today is key if you’re buying a home or refinancing. The interest rate you get will affect how much your loan costs and what you pay each month.

Things like your credit score, the length of your loan, and the type of loan you choose can all impact your rate. That’s why it’s important to compare rates and lenders to find the best deal.

By staying informed and making smart choices, you can confidently navigate the mortgage market.